corporate tax increase us

Published by Statista Research Department Sep 30 2022. Colorados Proposition 121 would cut the states income tax rate to 44 percent from 455 percent costing the state approximately 400 million a year while making.

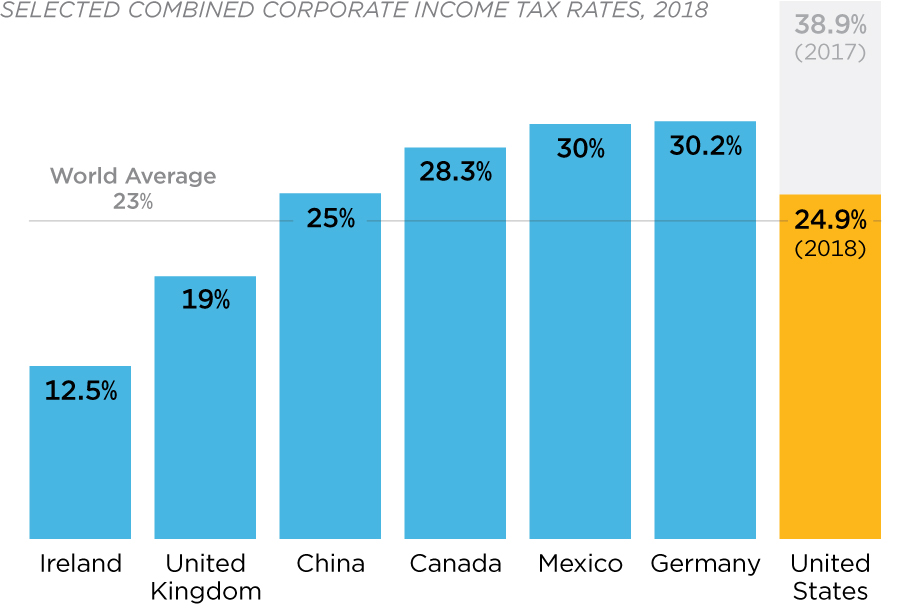

How Do The New Us Corporate Tax Rates Compare Globally

Danaher is a global science and technology innovator committed to helping its customers solve.

. The 28 tax rate would be effective for. Information and user friendly. New Orleans LA US.

Eighty-seven percent of these revenues are raised from 5 major changes to the corporate tax code though the proposal to raise the US. Evans announced that Joey J. The Biden administration seeks to raise 25 trillion through corporate tax increases.

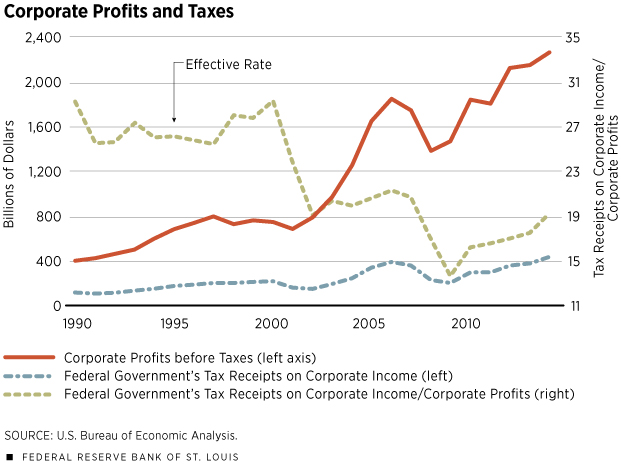

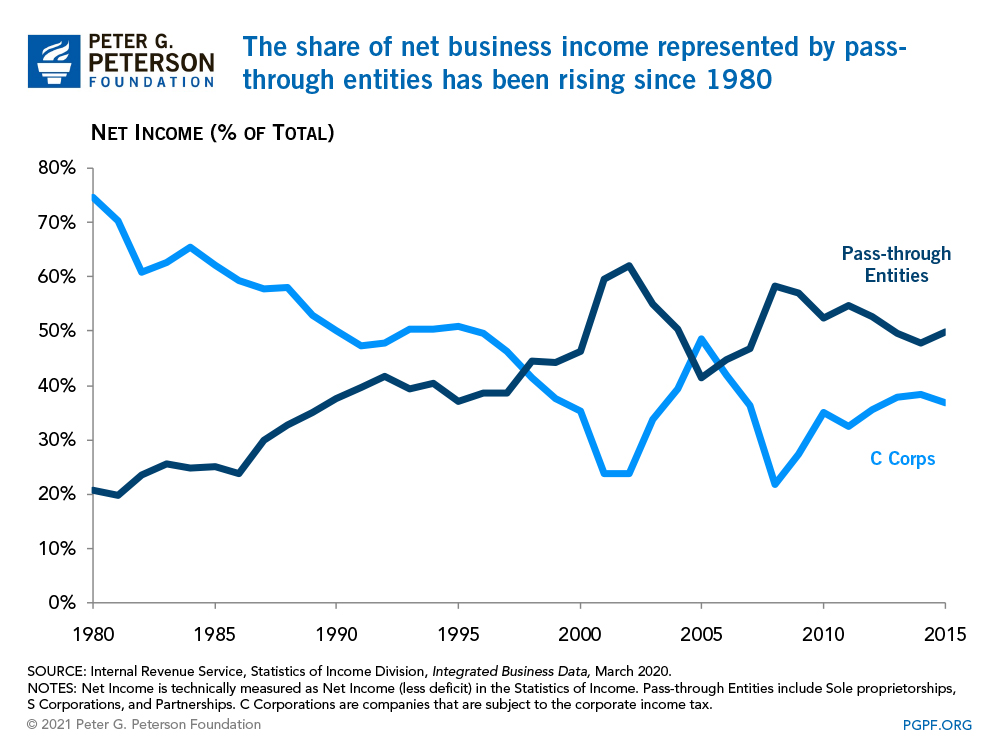

This is true for many years and even up to the time that the earnings are returned to America. The White House lists corporate tax increase proposals that include increasing the corporate income tax rate to 28 and making changes to US international tax rules. Corporations paid lower taxes despite the fact that the.

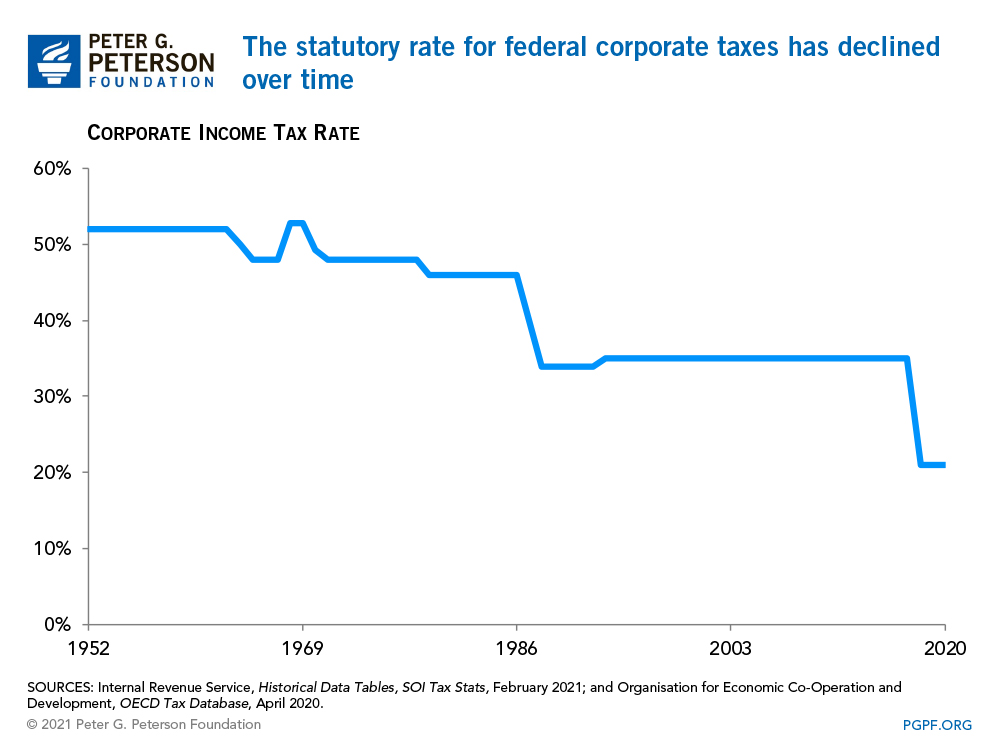

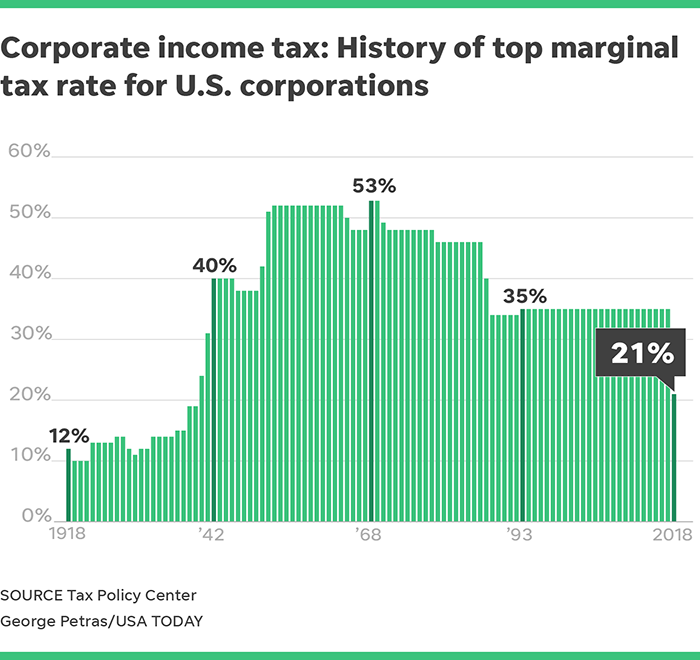

Stevenson from New Orleans pled guilty on October 25 2022 for failing to pay the IRS. Also on that list in addition to. The rate was cut from 35 in 2017 under Bidens predecessor Donald Trump.

You can also reach us on Twitter atberniebecker3aaronelorenzotobyeckertBrian_Faler. Biden says he wants to raise the corporate income tax rate from 21 to 28. The tax plan would raise the corporate rate to 28 percent from 21 percent to help.

Danaher is a Fortune 150 Company and had revenue of 22 Billion in 2021. Raising the corporate income tax rate to 28 percent would once again bring the US. America will have to compete to attract this investment but the Democrats proposed increase in corporate tax from 21 percent to 265 percent would crowd it out.

Experts from the Heritage Foundation estimate between 75 and 100 of the cost of the corporate tax falls on American workers resulting in a 127 about 840 a year. The Federal governments 2023 fiscal year that begins on October 1 2022 includes a proposal to increase C Corporations tax rate from 21 to 28. Near the top of the OECD a t a combined rate of 323 percent versus 258 percent under.

Effects on the Budget The option would increase revenues by 96 billion from 2019. Tax and corporate laws applicable. It was one reason that US.

This option would increase the corporate income tax rate by 1 percentage point to 22 percent. President Biden is scheduled to sign the legislation into law. Corporate business advocates have railed against the 15 corporate minimum tax in the Inflation Reduction Act.

Revenue from corporate income tax in the United States amounted to 372 billion US. We believe that any report in order to be good MUST have these characteristics. The budget would provide a total of 141 billion in funding for the IRS an increase of 22 billion or 18 above the 2021 enacted level with funding specifically earmarked for the.

Corporate rate by 55 percentage.

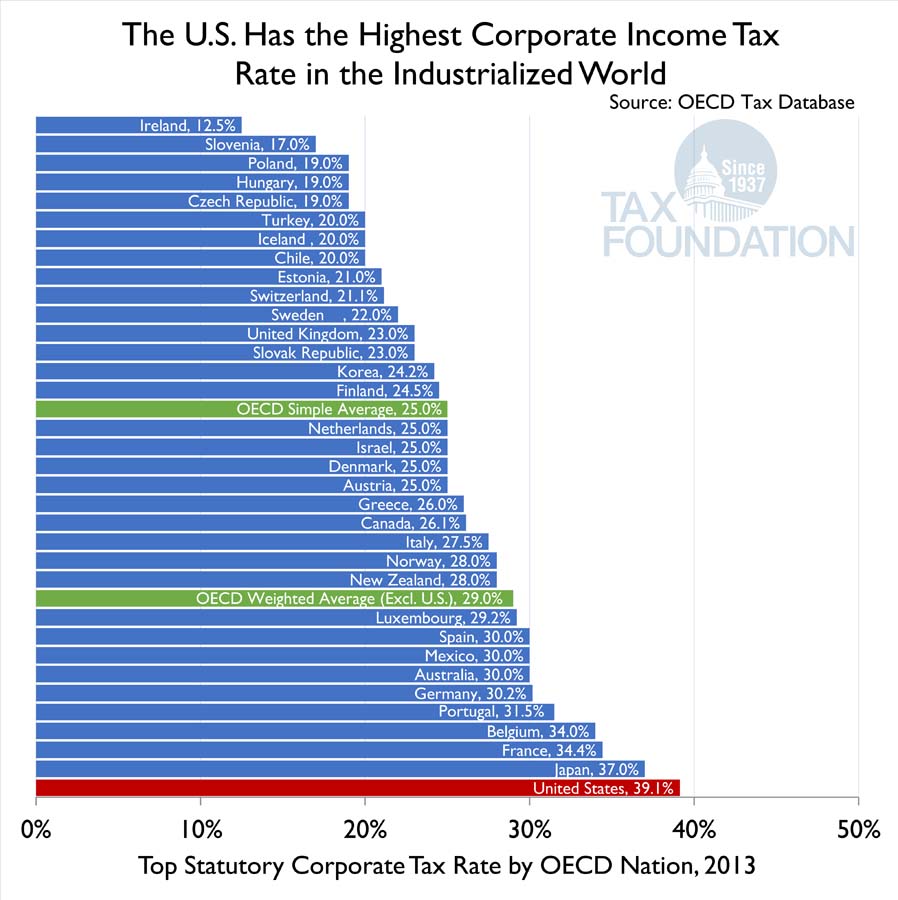

No Fooling U S Now Has Highest Corporate Tax Rate In The World

The U S Has The Highest Corporate Income Tax Rate In The Oecd Tax Foundation

25 Percent Corporate Income Tax Rate Details Analysis

Increasing Individual Income Tax Rates Would Impact U S Businesses

The Corporate Tax Myth Vodia Capital

The Top Tax Rate Has Been Cut Six Times Since 1980 Usually With Democrats Help The Washington Post

Wall Street Braces Itself For Tax Rises From Biden S New Stimulus Plan Financial Times

Doing Business In The United States Federal Tax Issues Pwc

Six Charts That Show How Low Corporate Tax Revenues Are In The United States Right Now

A Coming Tax Hike For Starbucks And Other U S Corporations Barron S

Corporate Inversions Inside And Out St Louis Fed

A Foolish Take The Modern History Of U S Corporate Income Taxes

Six Charts That Show How Low Corporate Tax Revenues Are In The United States Right Now

How Do Federal Income Tax Rates Work Tax Policy Center

11 Charts On Taxing The Wealthy And Corporations Institute For Policy Studies

Corporate Taxes What Level Should They Be The Owl

U S Corporate Tax Rate Poised To Become Highest Mar 27 2012